Since the beginning of March this year, there have been violent conflicts in Eastern European countries, and domestic enterprises have faced unprecedented complex international changes and the combined impact of repeated epidemics. Many changes have taken place in the supply chain and demand, and some domestic companies have experienced huge risks and losses in their business in Eastern European countries. Coupled with the repeated outbreaks of the new crown epidemic in various places, many enterprise personnel are unable to carry out normal domestic and foreign exchanges, international logistics and express delivery and other business expenses are soaring and transportation delays, and overseas merchants cannot carry out work such as inspection of factories, inspections, and samples, etc. , enterprises have encountered more and more obstacles and difficulties in developing the international market.

As the international situation brought about by the Russian-Ukrainian conflict becomes increasingly complex, there may also be potential business opportunities for domestic companies.

1. Changes in the international supply chain situation

1. Since the conflict between Eastern European countries, some Central Asian and European customers who previously purchased goods from Russia, Ukraine and other places have begun to turn to China and other countries to find sources of goods. For example, European and other customers who purchased fertilizers and automobile chassis from Russia have now begun to look for Chinese suppliers.

2. Similarly, because Russia, Belarus and other countries are subject to comprehensive financial, technological and trade sanctions by Western countries, some commodity supply chains in Russia, Belarus and other countries have been interrupted, and new supply-side sources are urgently needed, and these needs will be given to domestic enterprises. Bring some new business opportunities. For example, a large number of cars in Russia are BMW, Mercedes-Benz, Volkswagen, Peugeot, etc. made in Europe, and the supply of accessories for these cars is currently affected.

3. Russia’s total foreign trade in 2020 was US$571.9 billion, down 15.2% from 2019, of which the export value was US$338.2 billion, down 20.7% year-on-year; the import value was US$233.7 billion, down 5.7% year-on-year. Mechanical and electrical products, chemical products, transportation equipment and other three types of commodities are the most imported products in Russia, accounting for about 56% of Russia’s total imports. Germany, the United States, Poland, and Japan are the main countries exporting products to Russia. In particular, German companies are the biggest competitors of Chinese companies in the export of mechanical and electrical equipment, light industrial products, plastics and rubber, optical clocks and medical equipment to Russia.

After the Russia-Ukraine conflict, with the sanctions and blockades against Russia by Western countries, a large number of Western companies have withdrawn from Russia. At present, India, Turkey, Vietnam and other countries are actively preparing and speeding up to undertake Western companies’ withdrawal from the Russian market. vacancy.

4. The most important commodity Russia imports from other countries is mechanical and electrical products. In 2018, Russia imported mechanical and electrical products of 73.42 billion US dollars, of which mechanical and electrical products imported from China were 26.45 billion US dollars, accounting for 50.7% of Russia’s total imports from China, accounting for Russia’s imports of mechanical and electrical equipment. 36% of the total, so the market share can be predicted, my country’s mechanical and electrical products export to the Russian market still has a large room for growth.

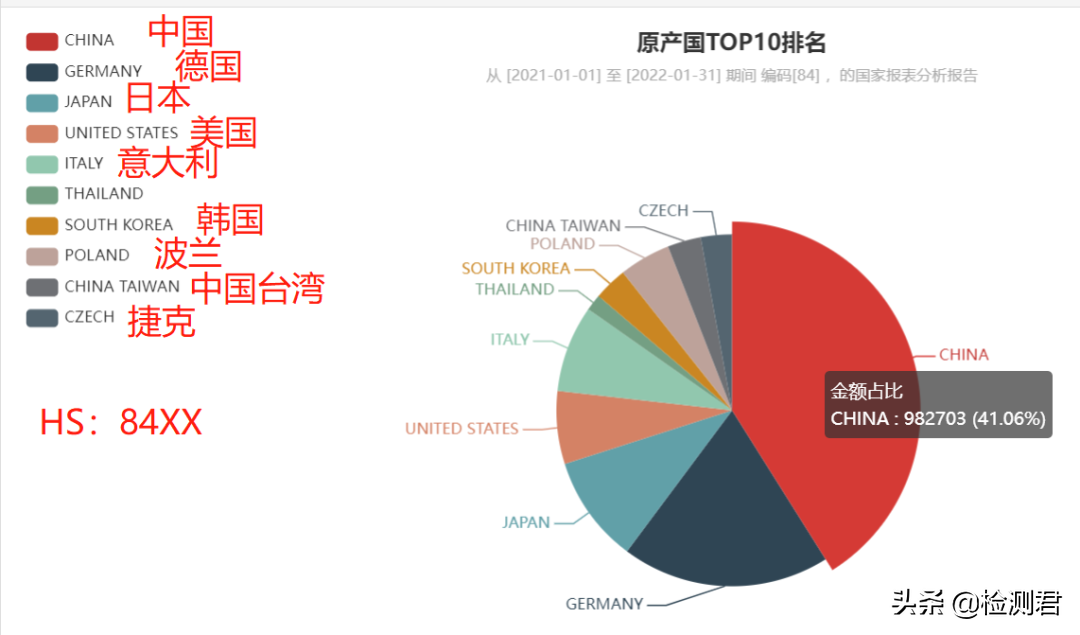

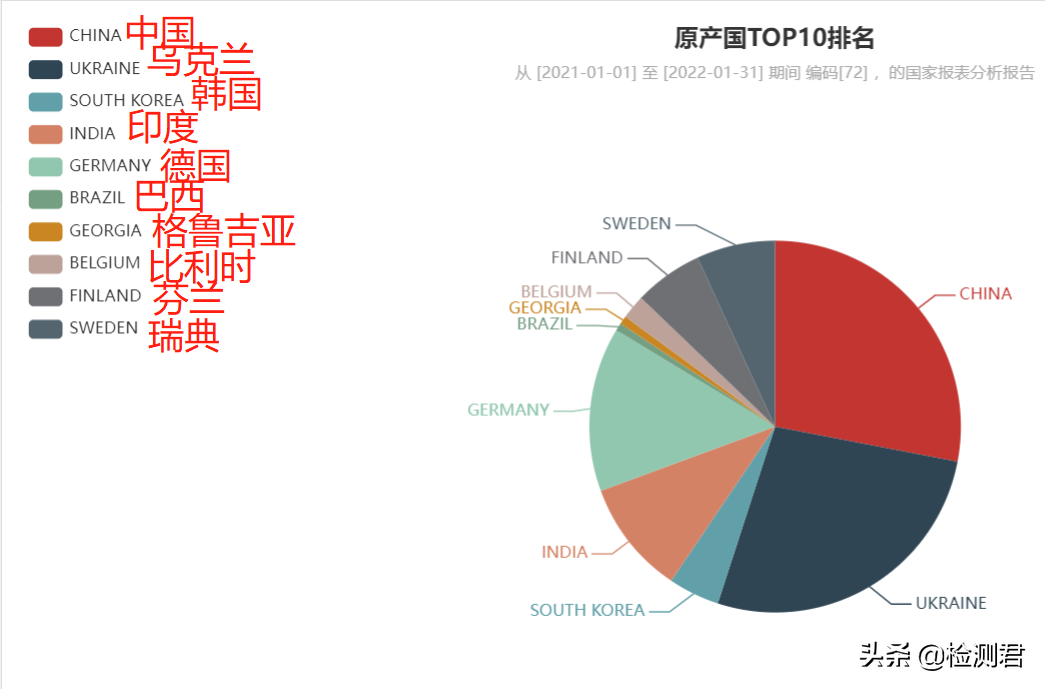

2021-2022 Russia Import Data Analysis of Electromechanical Equipment

From January 2021 to January 2022, in the past year, under the 84 code, Russia imported related products from 148 countries and regions. Among them, China is Russia’s largest import country of origin.

In 2021, China’s exports of mechanical and electrical products to Russia will be 268.45 billion yuan, an increase of 32.5%, accounting for 61.5% of the total value of China’s exports to Russia that year, an increase of 3.6 percentage points over the previous year. Among them, the export of general machinery and equipment, auto parts and automobiles grew rapidly, increasing by 82%, 37.8% and 165% respectively.

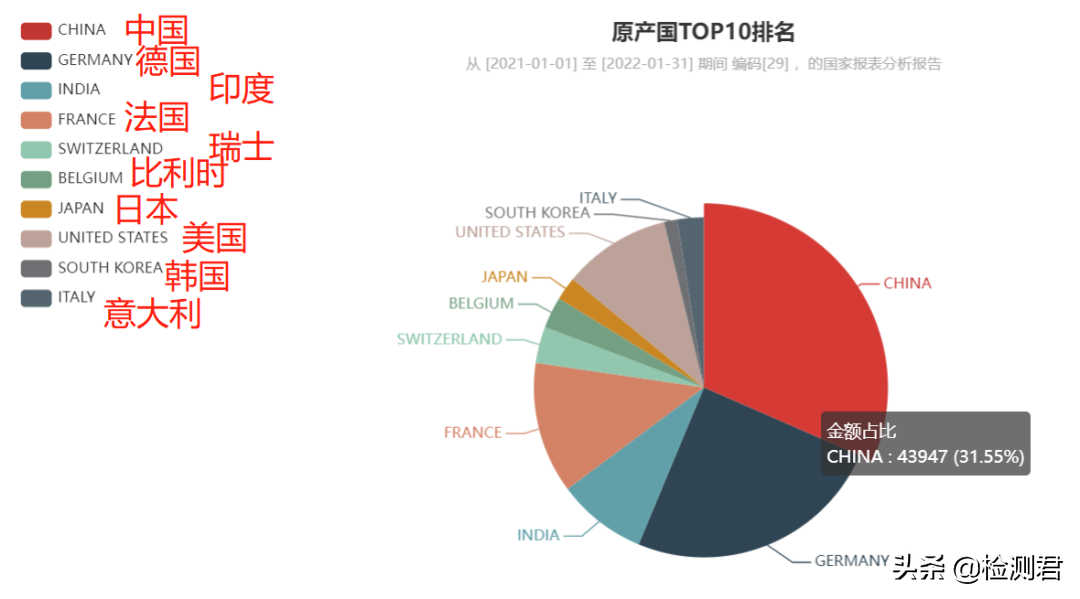

5. The next major commodity imported by Russia is chemical products. In 2018, Russia imported 29.81 billion US dollars of chemical products.

2021-2022 Russia Chemical Products Import Data Analysis

From 2021.1 to 2022.1, in the past year, under the 29 code, Russia imported related products from 89 countries and regions. Among them, China is Russia’s largest import country of origin

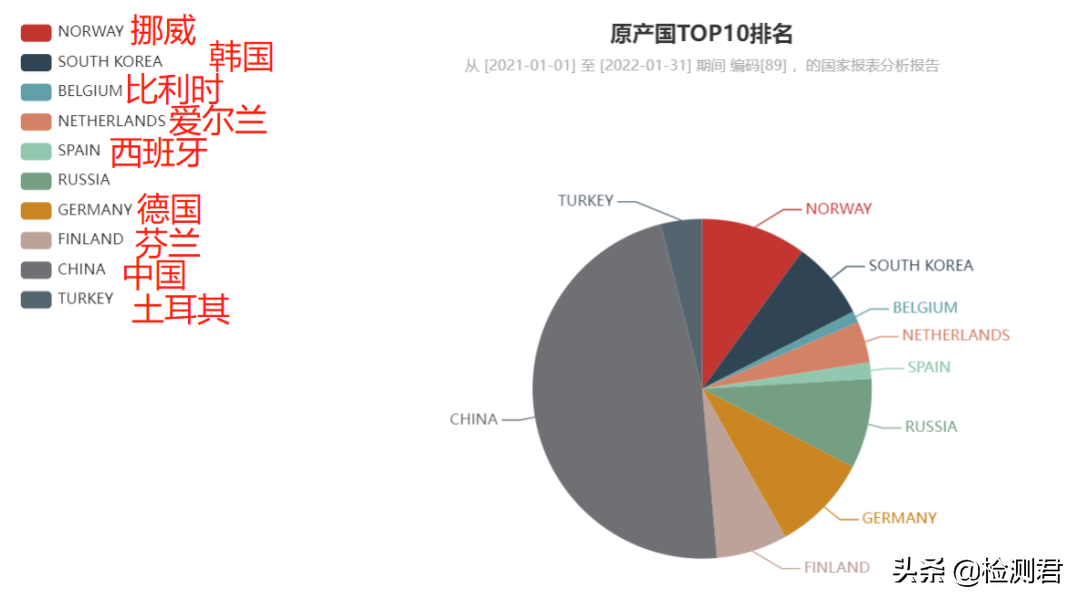

6. The third commodity imported by Russia is transportation equipment. In 2018, Russia imported transportation equipment of about 25.63 billion US dollars. In Russia’s transport equipment imports, products from China accounted for 8.6%, which was higher than Japan and Germany by 7.8 and 6.6 percentage points.

2021-2022 Russia Transportation Equipment Import Data Analysis

From January 2021 to January 2022, in the past year, under the 89 code, Russia imported related products from 148 countries and regions. Among them, Norway is Russia’s largest importing country of origin.

7. In addition, in 2021, Russia’s imports of base metals and products, textiles and raw materials, furniture, toys, miscellaneous products, plastics, rubber, shoes, umbrellas and other light industrial products, optical clocks and medical equipment and other major commodities imported from China will also occupy the Important market shares, accounting for 23.8%, 34.7%, 47.9%, 17.2%, 53.9% and 17.3% of Russia’s total imports of similar commodities. In 2021, China’s exports of labor-intensive products such as clothes, shoes and household items to Russia will reach 85.77 billion yuan, an increase of 2.5%, accounting for 19.7% of China’s total exports.

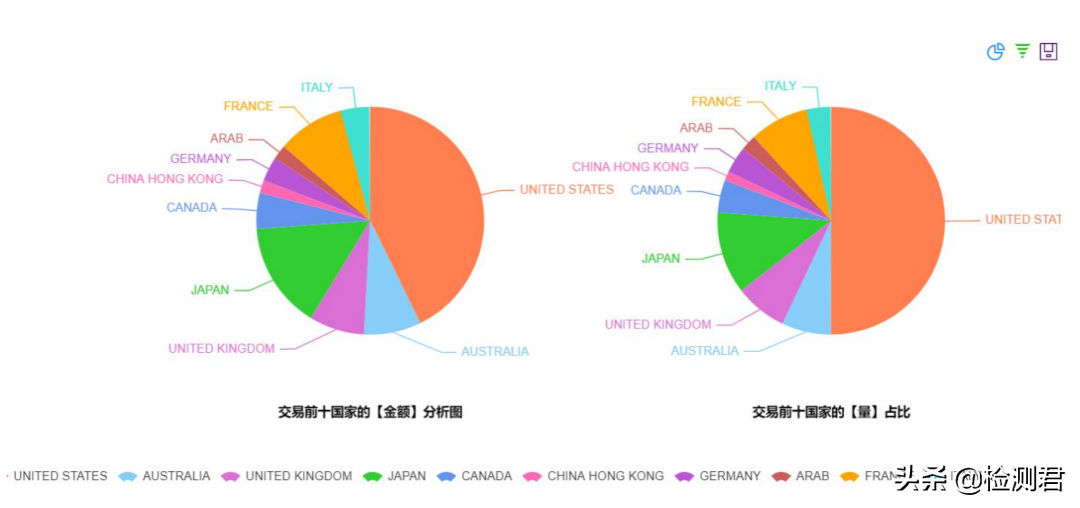

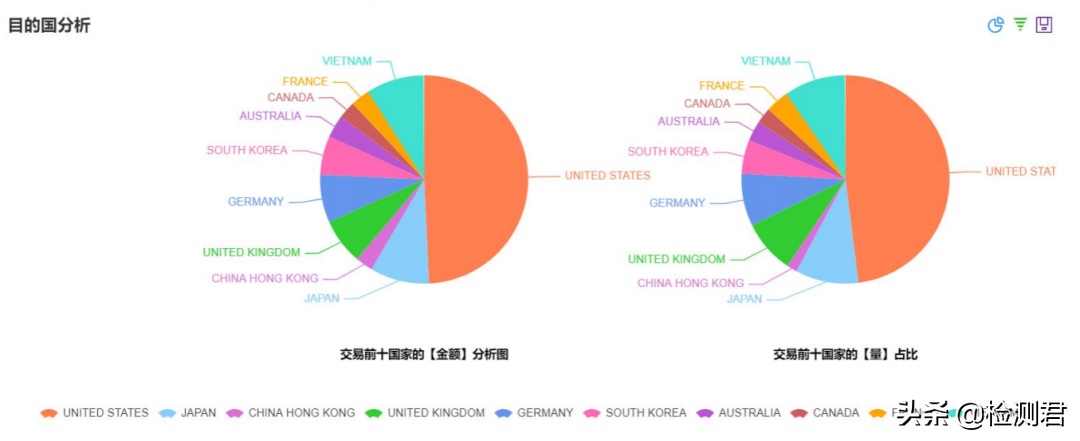

2020-2021 China Children’s Clothing Export Data Analysis

From October 2020 to October 2021, in the past year, under the 6111 code, the top 10 countries in the export ranking of children’s clothing are: the United States, Japan, Australia, France, the United Kingdom, Canada, Italy, Germany, the United Arab Emirates, Hong Kong, China, etc. The export of children’s clothing has a total of 6,573 shipments of goods exported to 178 countries and regions around the world.

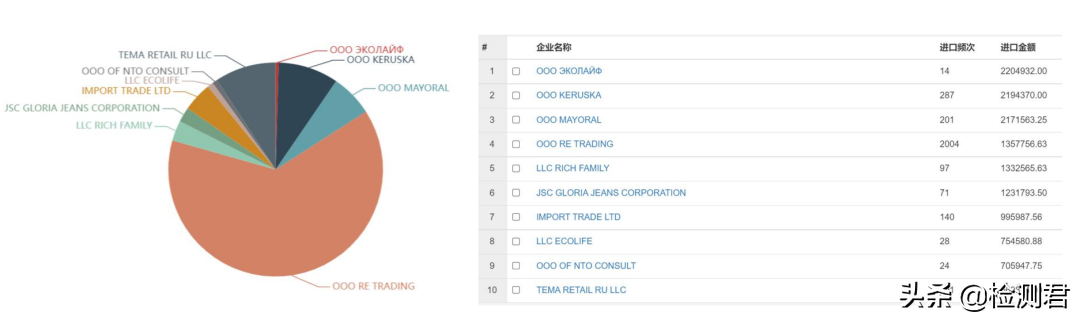

2020-2021 Top 10 Russian Children’s Clothing Importers

From October 2020 to October 2021, a total of 389 companies in Russia were engaged in the import of children’s clothing (HS6111). The above chart is the list of TOP 10 importers. The import amount is about 670,000 US dollars. (The above data is only the formal customs declaration data).

2020-2021 China’s footwear export data analysis

2020-2021 Top 10 exporting countries analysis From 2020.10-2021.10, in the past year, under 64 codes, the top 10 exporting countries of footwear are: the United States, Japan, South Korea, Australia, France, the United Kingdom, Canada, Germany, Vietnam, Hong Kong, China, etc.

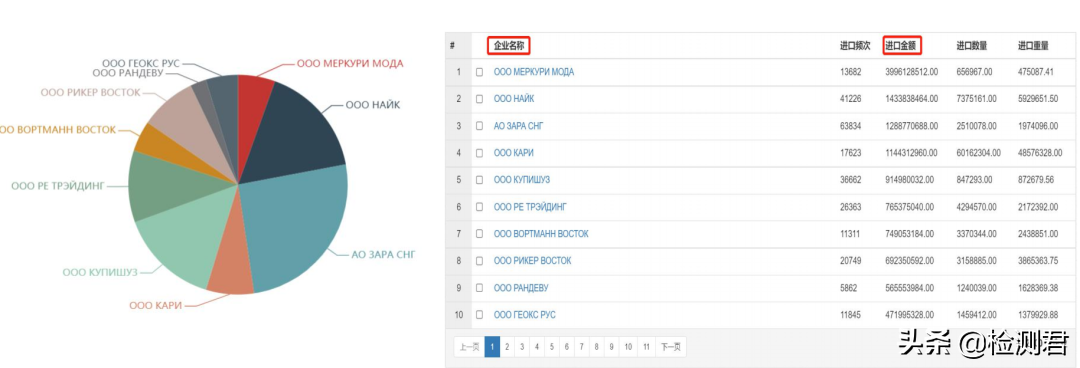

2020-2021 Top 10 Russian Importers of Footwear Products

From October 2020 to October 2021, a total of 2,000 companies in Russia were engaged in the import of footwear (HS64). The above chart is the list of TOP 10 importers. The TOP 1 is ООО МЕРКУРИ МОДА, the import value is about 4 billion rubles, and the TOP 10 is TEMA ООО ГЕОКС РУС, the import value is about 407 million rubles. (The above data is only the formal customs declaration data).

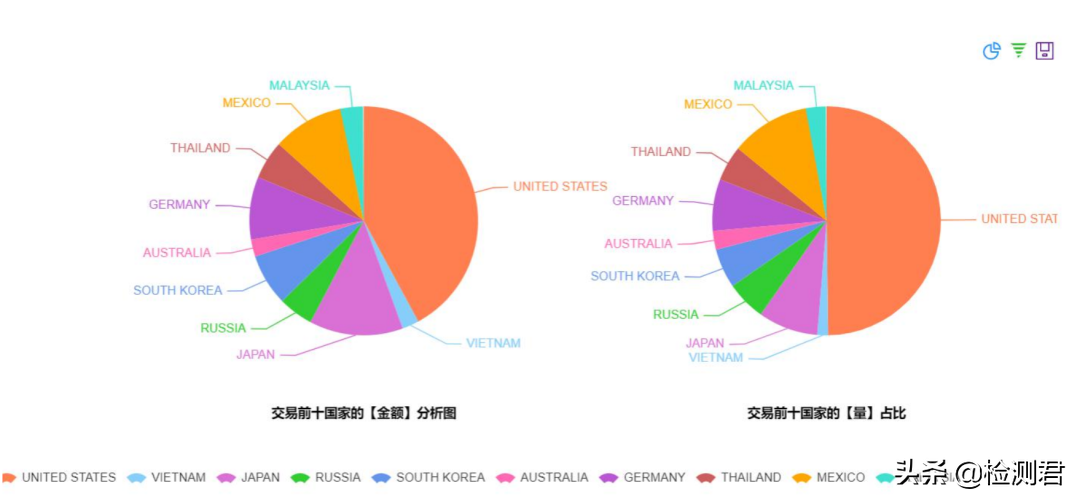

2020-2021 China Auto Parts Export Data Analysis

From October 2020 to October 2021, in the past year, under the 8708 code, a total of 114,864 goods were exported to 217 countries and regions around the world.

The top 10 countries in the export ranking of accessories are: the United States, Japan, Australia, Germany, South Korea, Mexico, Thailand, Malaysia, Vietnam, Russia, etc.

2020-2021 Top 10 Russian Importers of Footwear Products

From October 2020 to October 2021, there are more than 2,000 enterprises in Russia engaged in the import of auto parts (HS8708). The above chart is the list of TOP10 importers. About 289 million yuan. (The above data is only the formal customs declaration data).

2020-2021 Russian Steel Product Import Data Analysis

From 2021.1 to 2022.1, in the past year, under the 72 code, Russia has imported related products from 70 countries and regions, of which China is Russia’s largest importing country of origin.

8. The oil and natural gas industry, which is an important source of Russia’s economy, has also been sanctioned by the West. Russia will inevitably increase the export of oil and natural gas to emerging countries in the next step, and will accelerate the construction of some oil and gas exploration, processing, transportation and other facilities. The equipment and technology are relatively mature, and domestic enterprises can increase their efforts to promote the export of equipment and technologies such as oil and gas extraction, refining, processing, transportation, and pipelines.

9. Medicines and medical equipment products also have huge market potential in Russia and Belarus. Before the conflict, Russia imported a large amount of medicines and medical equipment from the West, and Russia and Ukraine also exported medicines to Central Asia, Eastern Europe and other countries. After the Western sanctions, Russia temporarily released the intellectual property protection of Western medicine and other products, and simplified the packaging and certification requirements for imported medicines and medical device products. The market provides better business opportunities.

2. Suggestions for enterprises to develop markets in Russia, Central Asia and Eastern Europe:

1. Affected by the changes in the international situation, domestic enterprises need to do well in advance the development planning, talent pool, logistics and trade hub construction, and marketing network construction for the markets of Russia, Central Asia, and Eastern Europe. 2. We should vigorously participate in exhibitions and business activities in Russia, Central Asia and other countries, vigorously strengthen contact with customers in Russia, Central Asia, and Eastern Europe, carry out normal business exchanges, and vigorously build and pass overseas warehouses and exhibitions in the above regions. Channels and resources such as conferences, exhibition halls and logistics and distribution projects will develop the above-mentioned markets. 3. For some domestic enterprises that produce dual-use products, in order to avoid joint sanctions from the United States and other later stages, they should try to use third countries such as Central Asia and Eastern Europe to carry out trade with Russia and Belarus, and consider conducting business in Central Asia, Russia, and Eastern Europe. Production, processing and trade of related products. 4. We should vigorously promote domestic advantageous industries to go to Central Asia, Russia, and Eastern Europe. These products are not only necessities, but also alternative commodities that Russia, Belarus and other countries urgently need to find after conflicts and sanctions, such as: auto parts, mechanical and electrical equipment, electronic products , agricultural machinery, mining machinery, medical equipment, biomedicine, petroleum equipment, chemical products, etc. 5. Under the complex situation of the current conflict in Eastern Europe, it is very necessary for enterprises to strengthen the construction of the Belt and Road land hub – commodity distribution, logistics hub, and marketing network in Central Asia, and will take the first-mover advantage in the future international market competition . By developing business in Russia and Central Asia, domestic enterprises can not only promote product exports and quickly seize the large land market covering Europe and Asia, but also can integrate into the construction of the five links of the Belt and Road Land Silk Road, promote and stabilize regional and regional cooperation. economic development. 6. With the long-term and continuous sanctions against Russia and Belarus by the West and the increase in the market share of Chinese products in the above-mentioned markets in the future, in Russia, Belarus, and even the former Soviet Union countries affected by Russia, the export of Chinese products, Chinese standards and certification, RMB There will be many opportunities in settlement, barter trade, and construction of land, air, transportation and logistics.

3. Analysis of commodities entering the Russian and Central Asian markets through the Uzbek overseas warehouse exhibition hall:

1.The Republic of Uzbekistan has enjoyed political stability, rapid economic development and social stability in recent years. China-Uzbekistan relations are very friendly, and bilateral cooperation has great potential for development. 2. United Iron and Steel International Uzbekistan GOODY Overseas Warehouse and Exhibition Center is located next to the largest Sabra black import and wholesale market in Central Asia in Tashkent, the capital of Uzbekistan. It is a commodity circulation and distribution hub, and the overseas warehouse exhibition hall has unique commodity distribution flow Advantage. 3. Uzbekistan has more than 2 million people who do business and work in Russia, Eastern Europe and other places all year round. Uzbekistan businessmen have a long tradition of connecting East and West commerce and trade, and have the talents, language, geography, visa and other advantages to carry out cross-border trade. 4. Uzbekistan is a member of the Commonwealth of Independent States and enjoys the most-favored-nation treatment granted by Europe, the United States, Russia and other countries. Commodities from Uzbekistan enter the Eurasian Economic Union countries, Central Asia, Europe and the United States and other countries, enjoying the advantages of trade facilitation and tariff reduction. 5. Tashkent, the capital of Uzbekistan, is an important trade circulation and logistics hub in Central Asia. Commodities can be quickly distributed from Uzbekistan to Russia, Eastern Europe, Central Asia, South Asia, West Asia and other places. With the escalation of EU sanctions against Russia and the closure of transit ports, China-Europe freight trains may be fully affected. In order to ensure the supply of goods to Russia, road and rail logistics from Central Asia, Uzbekistan, Kazakhstan and other regions will play an important role. 6. Uzbekistan is rich in mineral resources and agricultural resources, but its industrial base is weak. Uzbekistan has good infrastructure and high-quality low-cost human resources. The economic complementarity between China and Uzbekistan is very obvious.

Post time: Aug-12-2022