In 2021, the world economy has been in a period of relative turmoil. Under the influence of the post-epidemic era, the online consumption habits and consumption quotas of overseas consumers have continued to increase, so the share of cross-border e-commerce in foreign markets has shown a significant growth trend. At the same time, behind the rapid growth, competition and challenges also follow. First of all, more and more consumers will be more inclined to choose the brand official website channel, which means that on the one hand, sellers should strengthen their own brand building and at the same time pay more attention to the construction of independent brand channels; secondly, affected by the IDFA policy, the original The “one-stop” marketing model of the company is facing greater challenges. Sellers need to face more fragmented access channels, and at the same time, they have to face the more complex effect tracking and analysis environment brought about by this.

The global online retail market grew by 26% in 2020, and data predicts it will continue to grow: a recent study shows a compound annual growth rate of 29% between now and 2025. Although expanding multiple markets at the same time does not require the huge pressure of inventory, capital and manpower as before, but with the “fame” of cross-border e-commerce, the influx of a large number of novice sellers has also intensified market competition. Therefore, how to It is important to enter the right market at the right time. If 2017 has been an excellent time to deploy in the Southeast Asian market, then it is time to consider the following markets at the end of this year and early next year.

1. These seven cross-border e-commerce markets have attracted the attention of the industry

1. Brazil

Brazil is the most important e-commerce market in Latin America, accounting for about 33% of its total market, and the only Latin American country in the global top 10 in 2019. Data shows that Brazil’s e-commerce market revenue in 2019 was US$16 billion, it is expected to reach US$26.5 billion this year, and is expected to exceed US$31 billion in 2022. In addition, according to a study on “Brazilian online shoppers and their use of cross-border e-commerce” conducted by the Brazilian Retail Association (SBVC) in collaboration with Ferraz Market Research, 59% of online shoppers prefer to shop abroad Shopping on websites and apps. 70% of people who have tried online shopping have purchased Chinese products online through cross-border channels. Relatively speaking, Chinese products are relatively well accepted by Brazilian buyers.

2. Mexico

As the second largest economy in Latin America, Mexico’s e-commerce market has become more and more popular. The data shows that the total size of the Mexican e-commerce market in 2021 will be 21.2 billion US dollars, and the market development space is very large. The country’s e-commerce market is expected to reach $24.3 billion in 2024. Nearly half of Mexican online shoppers have shopped cross-border, spending more than $9.6 billion in international markets. The country also has high digital penetration, with about 70 percent of Mexicans owning a smartphone and accessing the internet.

3.Colombia

Colombia is the fourth largest market in Latin America. Although the e-commerce market in the country was only $7.6 billion in 2019. But according to AMI (American Market Intelligence) forecasts, Colombia’s e-commerce market will grow at a rate of 150% to $26 billion by 2022. This success is possible because, on the one hand, venture capital has attached great importance to the Latin American market in the past few years, and on the other hand, it is also the result of the support of the Colombian government.

4.TheNetherlands

The Dutch e-commerce market is currently worth $35 billion and is expected to grow to $50 billion in just four years. 54% of online shoppers choose to shop across borders, indicating that they are willing to buy from non-Dutch or unfamiliar merchants if the shopping experience and price are right. In 2020, the average number of purchases made by online consumers in the Netherlands increased by 27%.

5.Belgium

The current Belgian e-commerce market is small at $13 billion, but it is growing at an astonishing 50% rate.

At the same time, 72% of Belgian digital shoppers are used to buying across borders, which means millions of online shoppers are willing to spend more to try unfamiliar brands and merchants if the shopping experience and offers are worth their while .

6.Poland

Data predicts that the Polish e-commerce market is growing at an astonishing rate of more than 60% per year and will reach $47 billion by 2025. Unlike several other markets, internet penetration in the country is almost 100%, however, currently, less than 20% of Polish online shoppers make cross-border purchases.

7.Indonesia

While this list focuses on the Latin American and European markets, we cannot fail to mention Indonesia. Indonesia has the fourth largest population in the world and a huge market. The data predicts that e-commerce sales in the country are expected to reach $53 billion this year and top $100 billion in 2025. Because the Indonesian market has strict restrictions on cross-border goods, it is not suitable for cross-border sellers who are engaged in drop shipping. However, on the other hand, the opportunity will be greater for those sellers who support shipping from home.

Although there are not many online shoppers in this market, which ranks fourth in population in the world, the situation is changing under the influence of the epidemic. Especially recently, the President directly stated that he would use the shortest time to build Indonesia into a digital economy in the ASEAN region. Template.

2. Is cross-border e-commerce still worth doing in 2022?

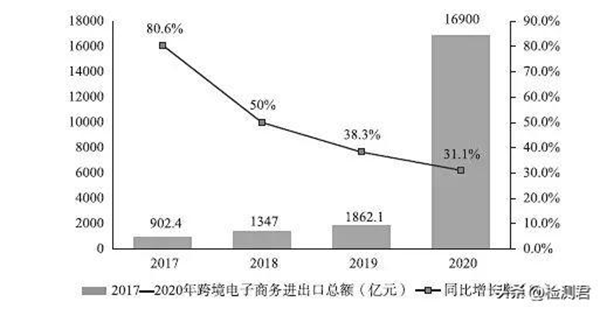

With the deepening of trade globalization, more and more enterprises are enjoying the development opportunities brought by cross-border e-commerce. As an emerging trade format, cross-border e-commerce is relying on its advantages of online, multilateral, localization, non-contact delivery, short transaction chain, etc., with a rapid growth trend, for the business expansion and future development of many sellers and enterprises play a positive role. According to the 2020 China E-commerce Report released by the Ministry of Commerce in September this year, domestic cross-border e-commerce is currently showing the following development status: The scale of cross-border e-commerce imports and exports maintains rapid growth: In 2020, domestic cross-border e-commerce is booming According to the data of the General Administration of Customs, the total import and export of cross-border e-commerce in China reached 1.69 trillion yuan, an increase of 31.1% on a comparable basis.

Image source “2020 China E-commerce Report”

Cross-border e-commerce import and export commodity categories have a high concentration and rapid growth: From the perspective of commodity categories, the top ten categories of cross-border e-commerce retail exports in mid-2020 accounted for 97%, and textile raw materials and textiles accounted for 97%. Products, optics, medical and other instruments; watches and clocks; musical instruments, leather, fur and products; luggage;

Image source “2020 China E-commerce Report”

Cross-border e-commerce trading partners are increasingly diversified: From the perspective of trading partners, the top ten destinations for China’s cross-border e-commerce retail exports are: Malaysia, the United States, Singapore, the United Kingdom, the Philippines, the Netherlands, France, South Korea, Hong Kong, China, Saudi Arabia. At the same time, according to third-party data released by several authoritative agencies, the vigorous growth of China’s cross-border e-commerce will not stop in 2022: the global cross-border e-commerce transaction volume is expected to reach 1.25 trillion US dollars in 2021; The scale of cross-border e-commerce imports and exports reached 1.98 trillion yuan, an increase of 15%. Nearly 70% of overseas consumers believe that Chinese brands are very important to the world today, and the future of Chinese brands can be expected; in conclusion, cross-border e-commerce has great potential in the future and has become an emerging trade format, and cross-border e-commerce retail exports in China Among the top five destinations, three markets are located in Southeast Asia, a hot blue ocean market.

Post time: Oct-17-2022